We expect interest rates to move modestly higher in 2022 based on near-term inflation expectations above historical trends and improving growth expectations once the impact of COVID-19 variants recede. Our year-end 2022 forecast for the 10-year Treasury yield is 1.75–2.00%. An aging global demographic that needs income, higher global debt levels, and an ongoing bull market in equities may keep interest rates from going much higher.

Most of this content was taken from Outlook 2022: Passing the Baton

Coming into 2021, we expected Treasury yields to move higher from their very low levels and they did. Higher inflation expectations, less involvement in the bond market by the Federal Reserve (Fed), and a record amount of Treasury issuance were all reasons we thought interest rates could end 2021 between 1.50% and 1.75%. For 2022, near-term inflation expectations above historical trends and improving growth expectations once the COVID-19 variants recede are reasons why we believe interest rates could move moderately higher from current levels. In 2022, we expect the 10-year Treasury yield to end the year between 1.75% and 2.00%. However, an aging global demographic that needs income, higher global debt levels, and an ongoing bull market in equities (which potentially means more frequent rebalancing into fixed income) may keep interest rates from going much higher in 2022. While we don’t expect interest rates to move much higher next year, because starting yields for core fixed income are still low by historical standards, returns are likely to be flat to the low single digits in 2022. Not a great year, but we should see an improvement over the negative fixed income returns we have seen in 2021.

The role of fixed income

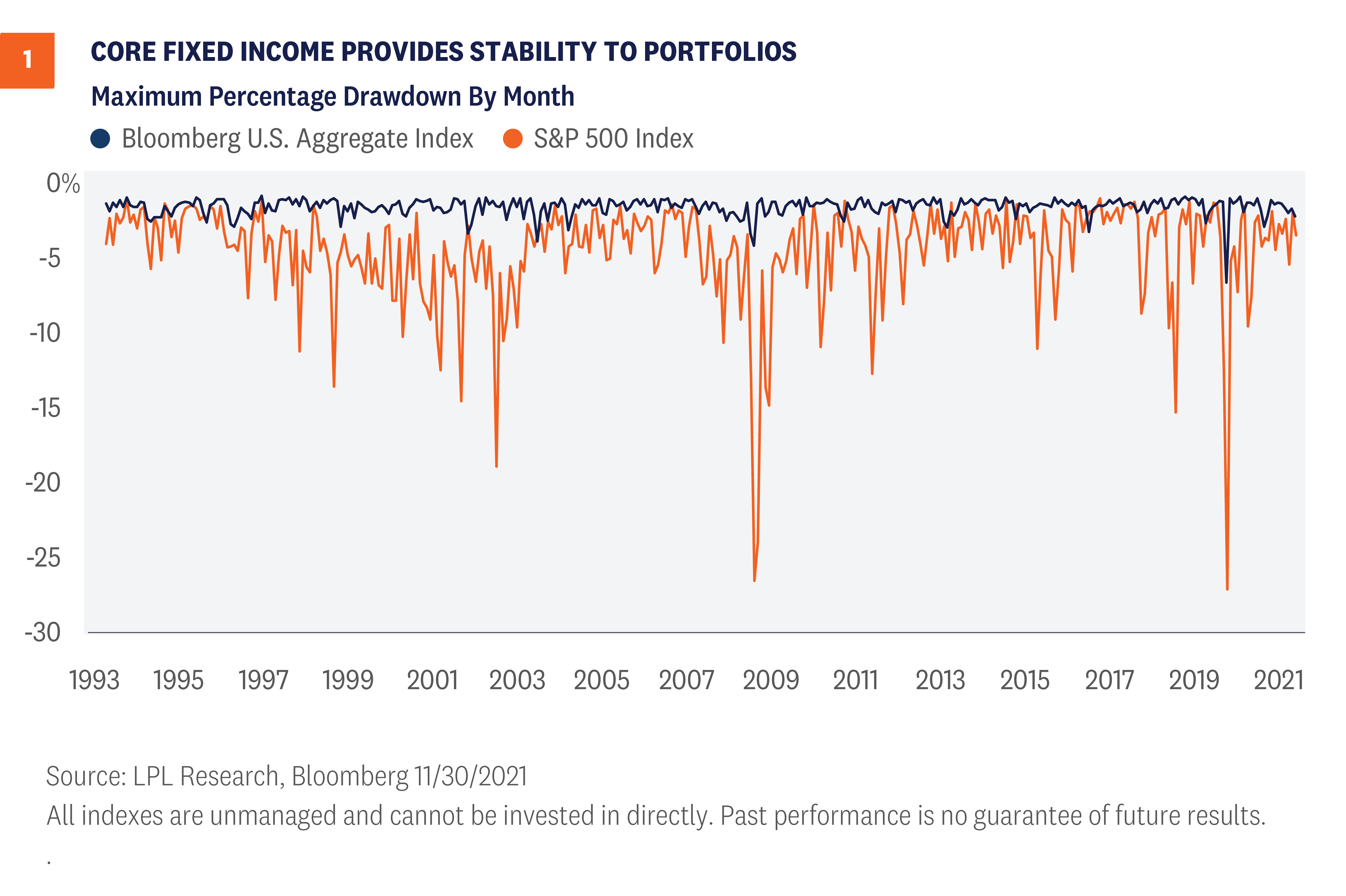

With long-term interest rates close to what we think will be cycle highs, it’s important to revisit the case for fixed income within a broader asset allocation. Core bonds have historically provided capital preservation, diversification, and liquidity to portfolios, which we think are important portfolio construction objectives and help clients remain committed to their investment goals. With the economy likely transitioning to mid-cycle, the need for high-quality bonds increases in our view. Moreover, the need to offset potential equity market volatility remains an important role for core fixed income.

Bonds, particularly core bonds, have been less volatile than stocks and have historically provided ballast to portfolios during equity market drawdowns, which as we know, are normal occurrences from time to time. The maximum drawdown for bonds, in any given month, has been dramatically less severe than stocks [Figure 1]. While the worst drawdown in a month for equities was -28%, the worst bonds have done during a month was down 6%, and those losses were quickly reversed. So, when combined with equities, bonds help reduce total portfolio volatility, which makes for a smoother investment experience for investors.

What’s next for credit?

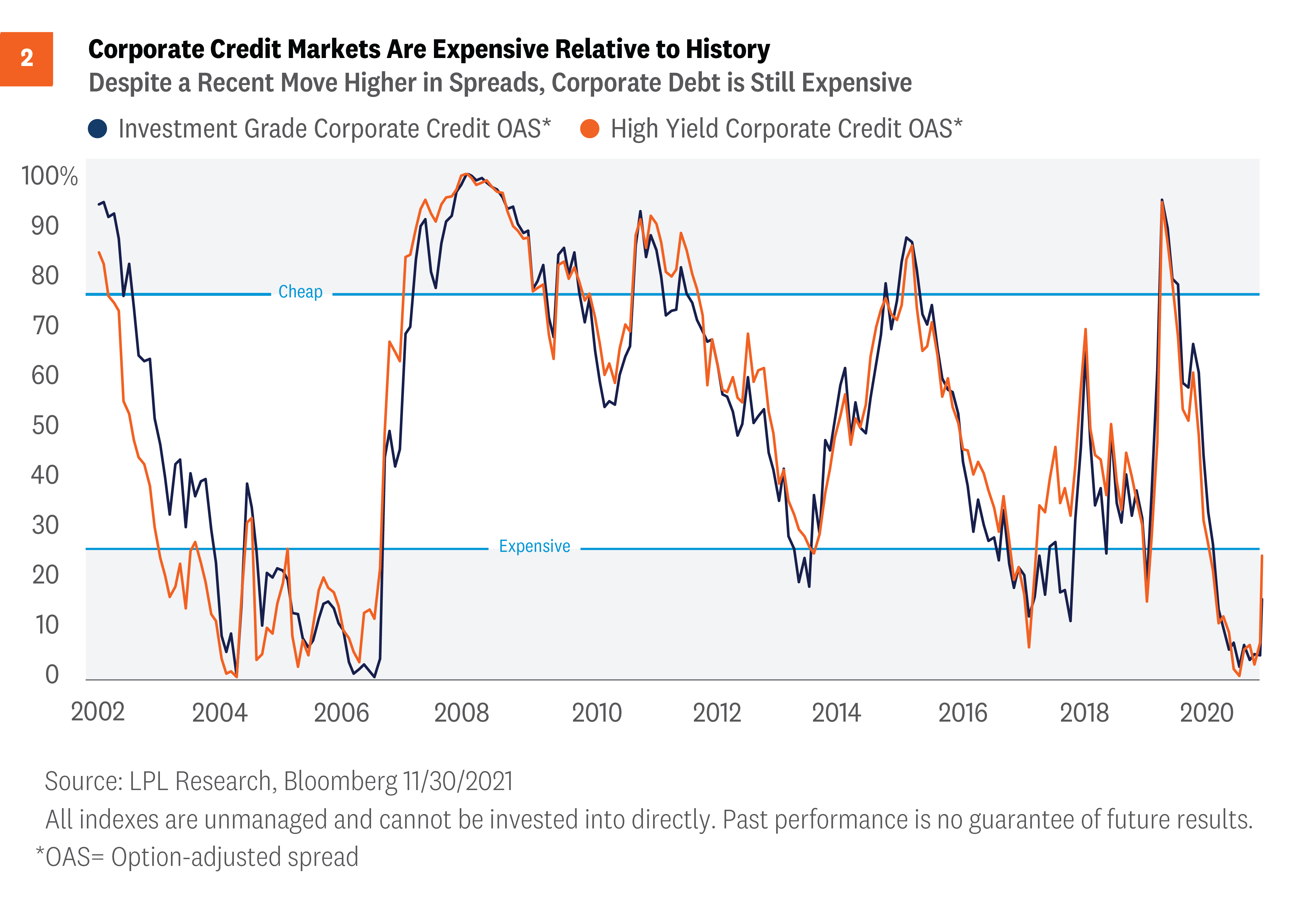

As interest rates increased during 2021, investment-grade corporate debt was negatively impacted as the sector, perhaps surprisingly, is among the most interest rate sensitive fixed income asset classes. U.S. high-yield investors, however, were rewarded for owning riskier debt. During the year, credit risk was rewarded as opposed to interest rate risk. As the economy transitions into mid-cycle, credit investors need to be more cognizant of downside risks. While the economy should still be conducive to credit risk and corporate balance sheets generally remain in good shape, credit spreads are among the lowest they’ve been in years, which means compensation for the added risk of corporates is low.

Both investment-grade corporate credit spreads and high-yield credit spreads are in the bottom 25% compared to history, which means valuations have been cheaper 75% of the time over the past 20 years [Figure 2]. Corporate credit markets, both investment grade and high yield, are currently priced near perfection, so any unforeseen event—either related to the economy or at the corporate level—could negatively impact credit markets. We remain neutral on investment-grade corporate credit, but we think equities continue to offer better upside return potential than high-yield bonds, where we remain underweight. For income-oriented investors willing to take on more risk, we think bank loans still make sense, where appropriate.

The Fed takes a step back

Since March 2020, the Fed has supported the economy and financial markets by purchasing $120 billion in Treasury and mortgage securities each month and by keeping short-term interest rates near zero. As the economy continues to recover, however, the need for continued monetary support wanes. The Fed recently announced accelerated plans to end its bond buying programs in March 2022 to provide optionality to raise interest rates should inflationary pressures remain elevated. As such, due to the Fed’s recent pivot, we think the Fed could start to raise short-term interest rates as early as June 2022 but acknowledge that an earlier timetable is possible.

More importantly, is how high the Fed tries to raise interest rates and how quickly it tries to get there. A slow deliberate pace of rate hikes, regardless of when liftoff takes place, will likely lead to a better outcome for the economy, and thus markets, than an overly aggressive one. The Fed is certainly aware of the risk of hiking interest rates higher than markets are anticipating. So, as it stands now, we think the Fed will likely tread lightly after the first few rounds of interest rate hikes next year.

Click here to download a PDF of this report.

______________________________________________________________________________________________

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

RES-988800-1221| For Public Use | Tracking # 1-05225134 (Exp. 12/22)