To say the U.S. economy has been difficult to read is an understatement. From generationally high inflation and interest rates to concerns about the labor market, it’s no wonder consumers are unsure about the overall health of the economy. In fact, in June, 59% of Americans believed the U.S. was currently in a recession (it wasn’t), according to a survey of 2,000 adults by Affirm. Conversely, prominent economists have downgraded the probability of a recession over the next 12 months to around 15% — this is the average probability of recession in any given year. But the Federal Reserve’s (Fed) very own recession forecasting model still says there is a 60% chance of recession over the next twelve months…huh? But after what looks like a temporary growth scare over the summer, economic growth data has been coming in generally better than expected lately, which has helped push Treasury yields higher, while at the same time pricing out the need for an aggressive rate-cutting campaign by the Fed. So, the question for fixed income markets in 2025 is how low will the Fed, absent an economic contraction, take the fed funds rate?

How Low Will the Fed Go?

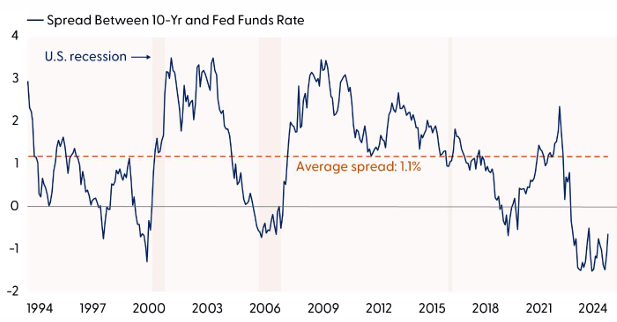

Current market pricing suggests the Fed will take the fed funds rate back to around 3.5–3.75% in 2025. If markets are right, and the U.S. Treasury yield curve eventually reflects its historical upward-sloping shape, that likely means the 10-year yield should remain around current levels. The spread between the fed funds rate and the 10-year Treasury yield has averaged around +1.1% in non-recession periods, meaning the 10-year yield, on average, has been higher than the fed funds rate by around 1.1%, albeit with a large range when not in a recession. So, unless/until economic data starts to show signs of a sustained slowdown, the 10-year could fluctuate between 4.0% to 4.5% to start 2025. But, if the economy does show signs of slowing, the Fed could cut rates more than what is priced in, which would mean the 10-year Treasury yield could get back into the 3.75–4.25% range to end the year, which is our expectation.

Yield Curve Could Steepen as the Fed Cuts Rates

Spread between fed funds rate and 10-year Treasury yield still negative

Source: LPL Research, Bloomberg 11/08/24

Disclosures: All indexes are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results.

That said, the risk for the bond market is a Fed that cuts too aggressively into a still-growing economy, which would then potentially rekindle inflation concerns. Moreover, as it relates to the Trump presidency, there is a concern that deficit spending (which would have likely happened under a Harris presidency as well) and tariffs could help growth but also keep inflationary pressures elevated. Better economic growth data and perhaps a too dovish Fed, along with more policy details from the Trump administration, could push Treasury yields higher. It will likely take negative economic surprises for yields to fall meaningfully from current levels, so investors should continue to prioritize income opportunities, which remain plentiful.

Return of the Treasury Term Premium

Stay with us here; this is where things get wonky, but important. According to economic theory, each security on the Treasury yield curve represents the expected fed funds rate over the security’s maturity, plus or minus a risk premium. The Treasury term (risk) premium is the additional compensation required by investors who buy longer-term Treasury securities. The term premium, which is unobservable and hence must be approximated, considers a variety of factors, including Treasury supply/demand dynamics, foreign central bank expectations, and the possibility of future inflationary pressures. And after years of a negative term premium, investors are just now getting compensated for owning longer-maturity Treasury securities. But that additional compensation is still below longer-term averages.

Investors May Demand Higher Yields

Treasury term premium remains below historical averages

Source: LPL Research, Bloomberg 11/08/24

Disclosures: Past performance is no guarantee of future results.

So, how does this affect fixed income investors? A positive term premium could keep longer-term interest rates elevated, perhaps reducing the diversification benefits of core bonds. Regarding the former, while monetary policy expectations will continue to be the dominant driver of interest rate changes, Fed rate cuts may not have the desired effect, and longer-term interest rates may not fall as much as they would have without a positive term premium (like we’ve seen recently). In terms of the latter, while we still believe Treasury securities will be the safe-haven choice in the case of a broad macro equity market sell-off, they may not be the best defensive option for garden-variety equity market sell-offs.

And, if we assume things get back to normal and the Fed sticks the soft landing, we could see that term premium increase back to long-term averages. As such, we don’t think right now is a good time to overweight duration (interest rate sensitivity) in fixed income portfolios. A neutral duration relative to benchmarks is, in our view, still appropriate. Moreover, for those investors that want to own bonds for income, the belly of the curve (out to five years) remains attractive.

Are Bond Vigilantes Headed to the U.S.?

Ed Yardeni, the veteran strategist, coined the term “bond vigilantes” in the early 1980s to describe investors who sought to exert power over government policies by selling their bonds, or simply threatening to do so. And after a brief hiatus, the bond vigilantes may be back — at least in the U.K. and France — as we’ve seen markets push back on recent budget proposals. But the risk is rising that perhaps the bond vigilantes could be headed to the U.S.

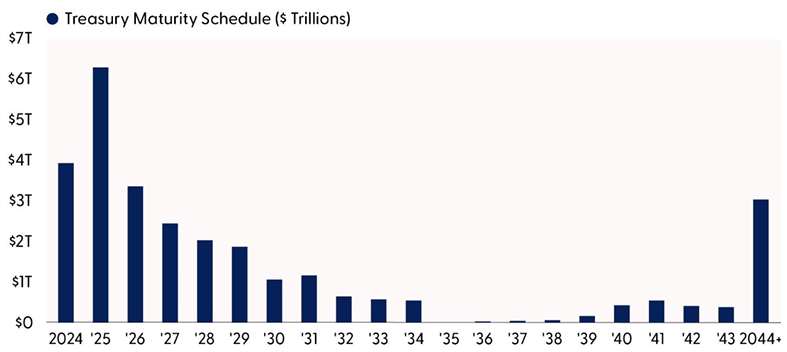

While economic growth will remain the driver of interest rates, a secondary risk to rates remains the amount of Treasury debt needed to fill federal budget deficits that are expected to stay elevated. Per the Congressional Budget Office (CBO), the U.S. government is expected to run sizable deficits over the next decade — to the tune of 5–7% of gross domestic product (GDP) each year. The deficit increases significantly in relation to GDP over the next 30 years, reaching 8.5% of GDP in 2054. That growth results from rising interest costs and large and sustained primary deficits. CBO deficit projections assume no new spending initiatives nor an extension of the Tax Cuts and Jobs Act, which is set to sunset at the end of 2025, so the CBO forecast likely underestimates budget deficits going forward. And to fill those deficits, the Treasury Department will need to issue trillions more in Treasury securities. But complicating the math for the Treasury Department, it will also need to roll over more than $6 trillion in Treasury securities set to mature in 2025. Thus, the Treasury will need to find investors for some $8 trillion of Treasury debt over the next 12 months.

Debt Deluge

Over $6 trillion in Treasury securities mature in 2025

Source: LPL Research, Bloomberg 11/08/24

Despite the mountain of debt and growing interest payments, the U.S. government is not at risk of financial collapse, nor are there concerns as such. As long as Treasuries are considered risk-free securities, there will always be buyers of Treasuries. Full stop. But with a Republican sweep of Congress and the White House, the deficit will likely remain broadly unchanged at elevated levels in the coming years or perhaps even grow given what we know so far about Trump’s policy proposals. And with the amount of Treasury supply, interest rates may need to stay higher than otherwise expected given economic data alone. And until/unless U.S. debt markets experience market volatility similar to what took place in the U.K. in 2022 or France in 2024, politicians are unlikely to take deficit spending seriously. We hope we’re wrong.

So where does that leave us? While a lot of attention is (rightly) focused on budget deficits and the amount of Treasury supply coming to market over the next few years, the primary driver of Treasury yields is still Fed policy. Our base case is that the Fed will take the fed funds rate to 3.75% (upper bound) in 2025. And after a few months of overly aggressive expectations, markets have generally repriced to be more in line with our expectations. As such, unless inflationary pressures re-accelerate, Treasury yields are likely past cycle highs.

Moreover, the current increase in supply will occur amid a backdrop of slowing inflation and Fed rate cuts. Investors might require some concessions to digest the larger issues (higher term premium), but the improved outlook for rate volatility in 2025 should attract some additional demand from the sidelines. As such, with the economic data (so far) continuing to reflect a more resilient economy than originally expected, we think Treasury yields are likely going to stay in a trading range, at least in the near term.

Despite the ongoing supply discussion, we think the 10-year Treasury yield could end the year between 3.75–4.25% and into 2025 with risks to both the upside and downside roughly balanced. In this new, higher-for-longer interest rate environment, income-oriented investors have a plethora of opportunities to build portfolios that can generate income levels in excess of 5% — much better than the opportunities that were available during the last decade when interest rates were near zero. Now, with interest rates still elevated, one might even call this current environment a golden age for income investors.

Asset Allocation Insights

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its tactical neutral stance on equities, with a preference for the U.S., a slight tilt toward growth, and benchmark-like exposure across the market capitalization spectrum. However, we do not rule out the possibility of short-term weakness as sentiment remains stretched and a lot of good news is priced into markets even as geopolitical threats escalate. Equities may also readjust to what may be a slower and shallower Fed rate-cutting cycle than markets are currently pricing in, although December seasonality is favorable for stocks.

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All investing involves risk, including possible loss of principal.

U.S. Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet or Bloomberg.

This research material has been prepared by LPL Financial LLC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

For public use.

Member FINRA/SIPC.

RES-0002562-1124 Tracking #670746/#670749 (Exp. 12/25)